Overview

MarketHub is a multi-vendor marketplace with over 50 independent sellers processing thousands of transactions daily. Before our intervention, each vendor managed their own payment gateway, leading to fragmented customer experiences, delayed settlements, and complex reconciliation processes.

We designed and built a centralized payment aggregator that processes all transactions through a unified interface while automatically distributing funds to individual vendor accounts based on configurable split rules.

The Challenge

The existing system presented several critical problems:

- Customers had to re-enter payment information for each vendor purchase

- Transaction fees varied wildly between vendors, creating pricing inconsistencies

- Manual reconciliation took 3-5 business days per vendor

- Platform fees and vendor payouts required manual calculation and transfer

- No unified view of payment analytics or transaction history

- Compliance and fraud detection were handled inconsistently

Our Solution

Architecture Design

We built a microservices-based payment aggregator with the following core components:

- Payment Gateway Abstraction Layer: Unified interface supporting Paystack, Flutterwave, and Stripe

- Settlement Engine: Automated split payment calculation with configurable rules per transaction

- Reconciliation Service: Real-time transaction matching and settlement tracking

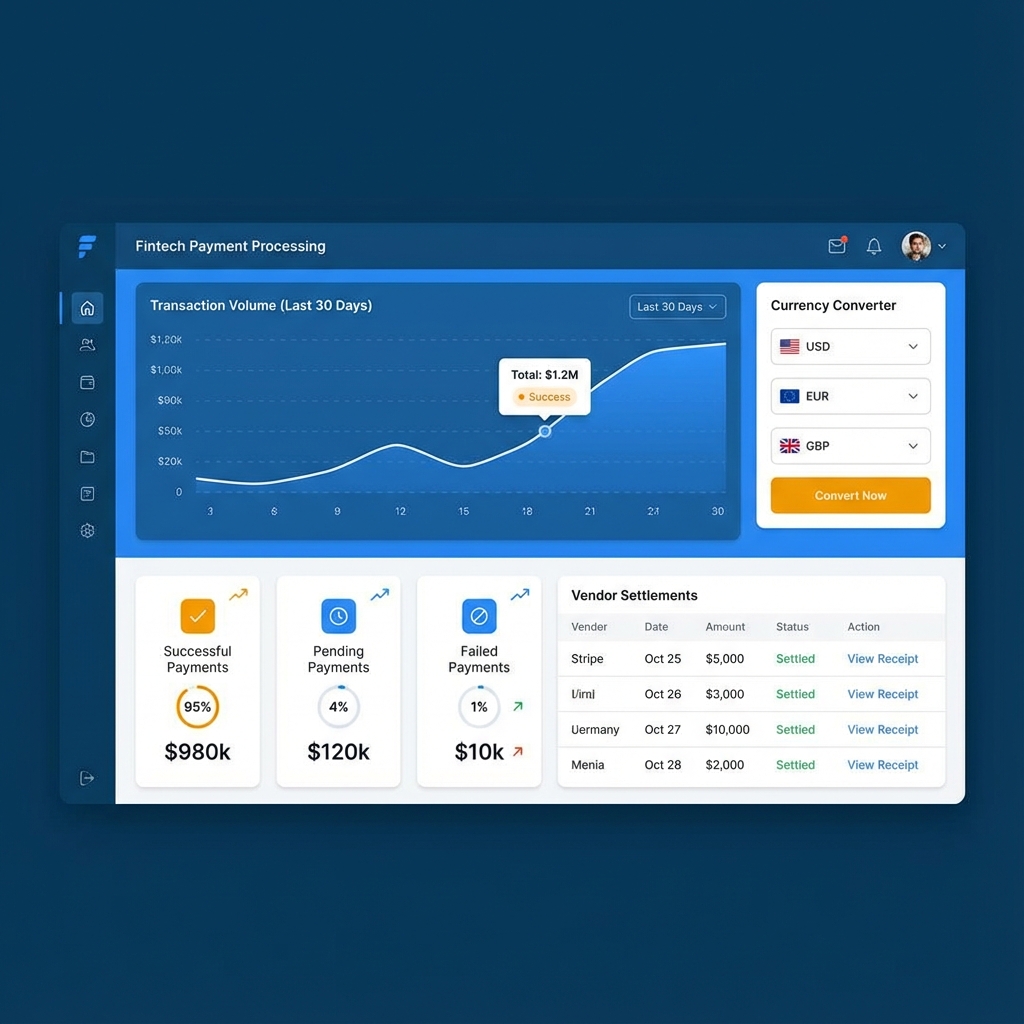

- Analytics Dashboard: Comprehensive reporting for both platform and individual vendors

- Compliance Module: Automated fraud detection and KYC verification

Key Features

The platform includes several innovative features that set it apart:

- One-click checkout across all vendors with saved payment methods

- Dynamic fee splitting based on product category, vendor tier, and transaction value

- Instant settlement to vendor wallets with configurable payout schedules

- Multi-currency support with automatic conversion and settlement

- Webhook-based event system for real-time integrations

- Comprehensive API for third-party integrations

Technical Stack

We selected technologies optimized for high-volume transaction processing and financial data security:

The system processes payments asynchronously using a message queue architecture, ensuring zero data loss even during high traffic periods. All financial transactions are encrypted at rest and in transit, meeting PCI DSS compliance standards.

Results & Impact

Within three months of deployment, the platform delivered measurable improvements across all key metrics:

Additional benefits included:

- Reconciliation time reduced from 3-5 days to under 10 minutes

- Customer cart abandonment decreased by 42%

- Vendor payout accuracy improved to 99.97%

- Platform revenue increased by 28% through optimized fee structures

- Fraud detection rate improved by 65% with automated screening

Client Feedback

"Keva Labs transformed our payment infrastructure from a liability into our strongest competitive advantage. The automated settlement system alone has saved us over 200 hours of manual work per month."

Need a Custom Payment Solution?

Let's discuss how we can build the perfect payment infrastructure for your business.

Start a Conversation